Financial statements overview

Automate financial statement and ratio calculation with a fully standardized profit and loss and balance sheet

Our financial statements feature provides lenders with a comprehensive view of a borrower's financial data, including profit and loss, balance sheet, and operating cash flow statements. Statements are categorized to a single chart of accounts allowing ratio analysis to be automated.

Use cases

Common uses of our financial statements feature include:

Financial statement analysis: identify potential red flags, such as declining profitability or increasing debt levels of your borrower, that could signal financial distress.

Ratio analysis: examine key ratios that offer insights into the borrower's financial strength, efficiency, and profitability.

Monitoring: continuously monitor the borrower's financial statements to track changes in their financial health over time.

Feature components

Feature enrichments

Categorized financial accounts

Businesses often have unique line items on their financial statements, which can pose challenges for comparison and automation. To address this, we've introduced a standardized set of financial categories called "account categories" for lenders. These categories enable seamless comparisons between companies. When connecting a company, our machine learning models predict the most suitable category for each account, drawing from extensive training on tens of thousands of accounts.

Each account category consists of up to five levels, with the most relevant level populated for each account.

Supported account categories

Recategorizing accounts

You can help improve the suggestions our model supplies by confirming them or providing a more applicable category. View all available categories proposed for accounts and, where relevant, recategorize them in the Codat Portal.

Recategorizing accounts in the Portal

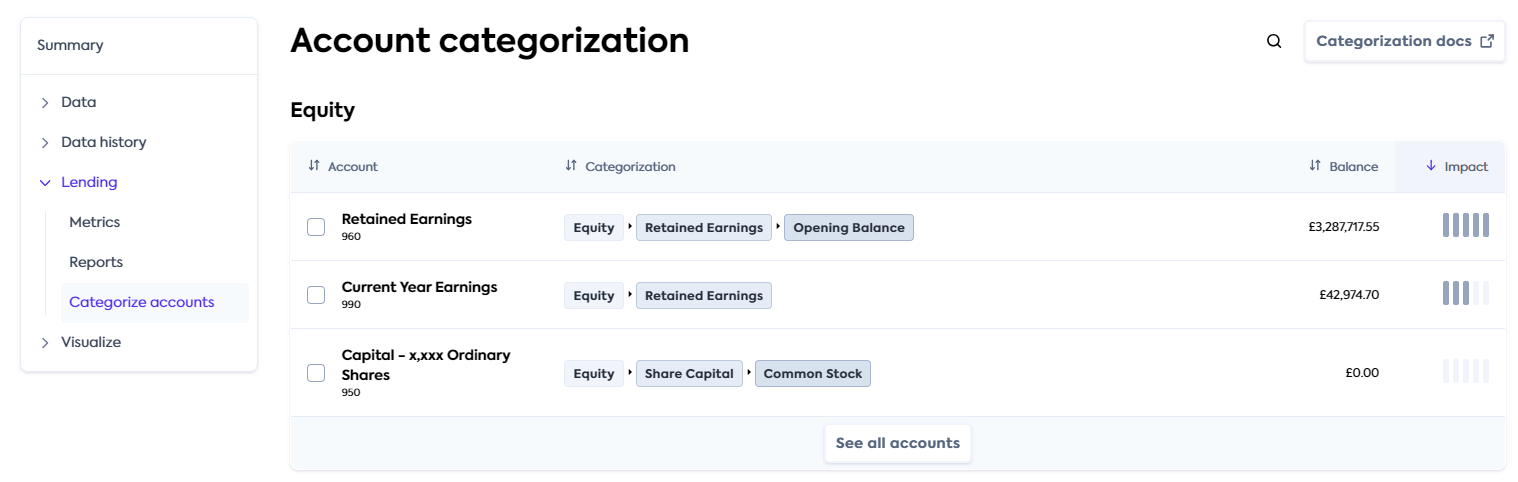

Navigate to Companies, then click the company that requires recategorization. Select Lending in the side menu and choose Categorize accounts to view the categories for each account.

These are ordered by impact by default, which is determined by the current account balance and our confidence in our automatic categorization.

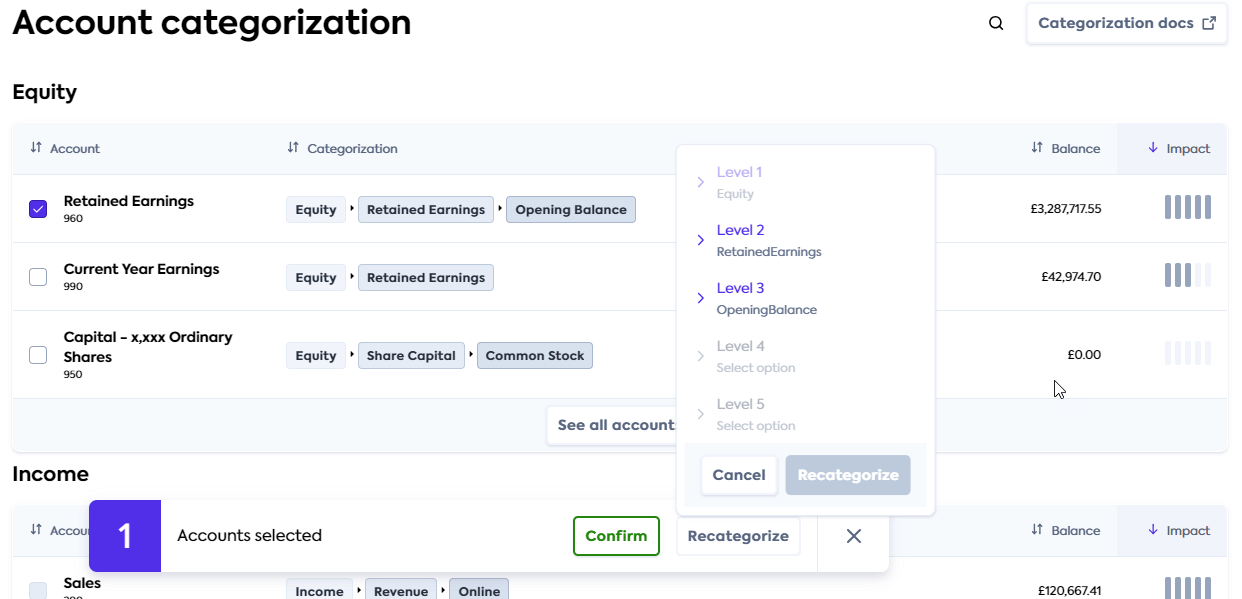

To change the category of an account, select the accounts using the checkbox and click Recategorize.

Choose an appropriate category from the proposed five levels and click Recategorize. This saves the newly assigned category.

That's it! Financial statements will return the updated category for the accounts going forward.

Supported outputs

You can retrieve the data pulled and enriched by this feature by downloading a report in an Excel format or calling the financial statements endpoints of our API.

Get started

Once you have the Lending API enabled, configure your instance to work with our financial statements feature.

Configure data sources

Follow the respective guides to set up and enable accounting integrations that will serve as a data source for the feature:

Enable data types and sync schedule

See how to enable data types and ensure the following data types have been switched on:

- Proft and loss

profitAndLoss - Balance sheet

balanceSheet - Cash flow statement

cashFlowStatement - Chart of accounts

chartOfAccounts

Configure the solution to refresh data when you need it by setting a synchronization frequency. We recommend setting it to a daily or a monthly sync.

Configure webhooks

We recommend you configure the following webhooks to manage your data pipelines. These webhooks send a notification for each dataType separately.

Dataset status has changed to an error state

If you receive a notification from this webhook, it means an issue occurred when syncing the specified data type. Resolve the issue and initiate the sync for this dataset again.

If you receive a notification from this webhook, it means data has been updated for the specified data type. This can include new, updated or deleted data. You should then refresh the data in your platform.

If you receive a notification from this webhook, it means categories associated with accounts have been updated for the categorized profit and loss statement and the categorized balance sheet statement components.

This update may be done automatically by Codat updating

suggestedcategories, or manually by a user updatingconfirmedcategories.